What Bank Can I Withdraw Money From My Emerald Card (2022)

The Emerald Card is a prepaid debit card that works like any other debit card. You can use the card to send money to other people, buy products online, pay bills and transfer money to a bank account.

Prepaid debit cards like Emerald function just like regular debit cards. You can transfer money to a bank account, pay bills, buy things online, and send money to other people.

Also, this article will show how to use the Emerald card to transfer funds to your bank account later. To save money for later use or to carry out other types of transactions in your bank account, you should have a prepaid card that enables you to transfer money to your account.

In addition, MetaBank issues the Emerald Card for usage with tax return deposits. You may use it at ATMs that accept MasterCard cards to access your money because it is a MasterCard. If a bank issued it, it was FDIC insured.

Also, you won’t lose your money if the financial institution in question fails thanks to FDIC protection. Every bank is required by law to maintain the security of every account it manages.

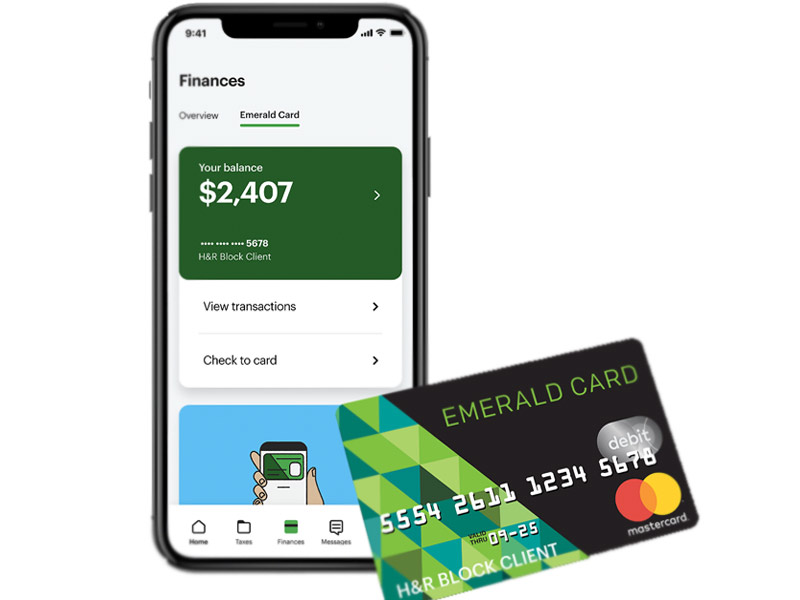

Interestingly, with the Emerald card, you can access the MyBlock mobile app to manage your account online. With just a few touches, you can execute your trades because you have quick access to your money.

Also, you may check your card balance and transaction history using an online account.

READ ALSO!!!

- Chase Bank Notary Services

- Amazon Hub Counter

- How Much is Costco Pizza

- Gamestop Return Policy

- 24 Hour Money Order

How do I get Money off my Emerald Card?

There are many options for withdrawing funds from your credit card. Here are some examples.

1. Through ATM

You can use your Emerald Prepaid MasterCard at any ATM that bears the Cirrus, Maestro, or Mastercard brand logos. Also, there may be a $3 withdrawal fee at some ATMs.

In addition, you can gain cash whenever you need it when you use an ATM to access your money.

2. Through the Bank

There is evidence that money can be withdrawn from a bank. Also, you can now use your money to make purchases you couldn’t previously do with your card.

3. Counter Stores

Your prepaid card can conduct withdrawals from your account at any financial institution that recognises the card.

However, there will be a transaction fee of $35.00 that you must pay. Also, you can avoid fees by using an ATM, which can save you about $32. Because the ATM withdrawal cost is only $3.

4. Cashback Stores

You can get cash back when you pay with your card at a taking part merchant. Also, you can be assessed a fee by the POS for the transaction.

5. Through Cheques and ACH Transfer

You can ask the card service provider for a check to cash out at a bank if you need to withdraw substantial sums of money that you cannot do so from an ATM.

Also, if you request a one-time automated clearing house, the business will move money from your card account to your bank account.

What is the withdrawal Limit for Emerald Card?

The Emerald card has no maximum balance. Emerald provides the opportunity to set that balance once you receive a card.

In addition, the Emerald card informs consumers about card restrictions and fees in order to make an educated choice.

Interesting, the Emerald card allows up to $3,000 in ATM withdrawals each day. Most cards normally have a $1,000 daily cap on ATM withdrawals.

Also, the $1,000 cash load cap set by Emerald, however, is lower than the industry standard. The typical cost is around $2,000. The $3,000 daily spending cap is comparable to the national average.

How to Transfer Emerald Card to Bank Account

Money transfers between accounts that are linked to the Emerald card are possible. Remember to link your card to a bank account when you apply for your card. This is typically a checking account that you use for regular business.

Also, you must go to the add bank area and provide your bank details, including the account and routing number, in order to link your bank account to your Emerald prepaid Mastercard.

In addition, after successfully connecting it to your PayPal account, you can transfer money into a bank account. This enables you to carry out several other kinds of transactions besides transferring money between your bank account and another person’s bank account.

READ ALSO!!!

- Stores That Do Cash Back (36+ Stores That Give Cash Back)

- How to Get Discounts on Hotels (16 Great Ways for Travelers)

- eBay Subsidiaries (History, Description, & Facts)

- Trader Joe’s Cashback (6 More Ways to Save at Trader Joe’s)

- Amazon Hub Counter+ (How to Collect from Amazon Hub Counter)

Frequently Asked Questions

1. What Bank can I Withdraw Money from my Emerald Card for Free?

Any ATM bearing the Mastercard, Maestro, or Cirrus brand logos allows cash withdrawals. Also, for ATM withdrawals, the card uses Axos bank.

2. What Bank can I use my Emerald Card at?

Anywhere Debit Mastercard is accepted, the Emerald Card can be used.

3. How much money can I Withdraw from my Emerald Card per day?

Interestingly, the maximum cumulative amount that may be withdrawn from an ATM per day is $3,000.00 per Card, subject to any lower limits imposed by an ATM owner or operator.

4. Where is a Free ATM for Emerald Card?

MoneyPass is one of the largest surcharge-free ATM networks in the world with over 33,000 ATMs. Also, MoneyPass now offers an ATM locator app for your smartphone.

5. Where can I Withdraw money from my Green Dot Card for Free?

The company granted green Dot cardholders access to all surcharge-free MoneyPass ATMs in the United States.

6. What ATM Allows you to Withdraw $1000?

Bank of America, BMO Harris, Capital One, and Charles Schwab bank allows you to withdraw up to $1000.

7. What Bank lets you Withdraw the Most Money?

Charles Schwab Bank allows you to withdraw the most money.

8. Can you Withdraw Money from a Different Bank?

If you have a debit card from one bank, you can typically use it to make cash withdrawals from an ATM from another bank.

Also, you might even be allowed to use the ATMs of another bank to deposit money in particular circumstances, if the banks are a part of a network that permits it.

9. How can I Withdraw More than my Daily Limit?

1. You can ask for a temporary increase in your daily limit.

2. To withdraw money, use a cash advance on your debit card.

3. With a purchase at the shop, receive cash back.

Let us know how this article was helpful to you in the comment section below. Also, please share this information with friends, family, and on social media.